PETALING JAYA: Oil and gas (O&G) stocks rose yesterday on the local bourse as several O&G service providers are expected to benefit from a multi-billion ringgit downstream project to be announced on Friday by the Government, and the gains in these stocks were also in line with the rise seen on the broader market.

.

.

.

.

Dialog Group Bhd, which was up 14 sen to RM2.70 with a turnover of 13.4 million shares yesterday, stands to gain from the RAPID project as it gives better visibility to its proposed RM5bil independent deepwater petroleum terminal in Pengerang.

“Besides the tank terminal project, Dialog has the edge in providing engineering, procurement and construction (EPC) operations as well as specialist services and plant maintenance activities for this new complex given the proximity of its existing tank terminal project.

Read it in The Star

Dialog climbs to fresh highs, investors upbeat on prospects

KUALA LUMPUR: Shares of DIALOG GROUP BHD [] climbed to fresh highs of RM2.73 in late afternoon trade on Thursday, May 12 as investors were upbeat about its prospects.

At 4pm, Dialog was up three sen to Rm2.73 with 12.71 million shares done.

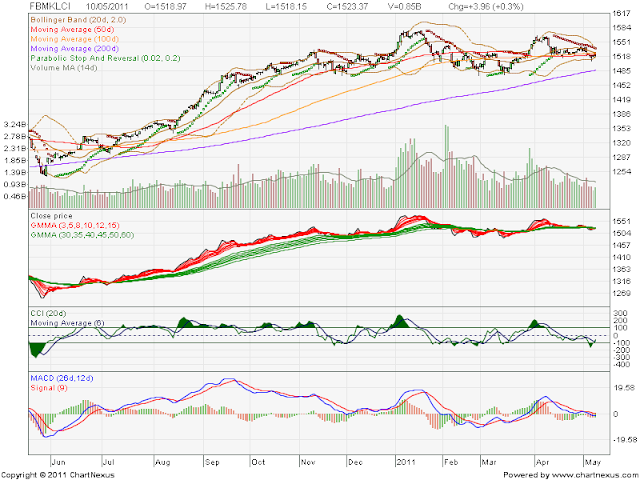

The FBM KLCI fell 1.88 points to 1,534.15. Turnover was 696.86 million shares valued at RM956.51 million. There were 250 gainers versus 447 losers and 279 stocks unchanged.

Petroliam Nasional Bhd is reported to be investing up to RM50 billion in new integrated downstream project to expand its business and further spur the growth of Malaysia’s oil and gas downstream sector.

The signing ceremony is expected to be done on Friday.

Then project would likely be the independent deepwater petroleum terminal project at Pengerang, Johor which is jointly undertaken by Dialog and Vopak.

Dialog and Vopak’s combined investment in the terminal would be RM5 billion and over a seven year period. Dialog’s investment would be RM2.5b of which 30% would be from equity and 70% from project financing.

Dialog and Vopak are the core facilitators for the project, which is viewed as an entry point project (EPP) under the government’s Economic Transformation Policy (ETP).

There are tremendous spinoffs opportunities from the Pengarang project and attract combined investments of another RM95 billion.

Read it in The Edge