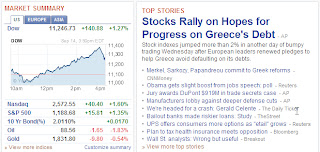

Despite a long-term picture in Europe that appears to be as unsettled as ever, investors will take any bit of good news and run with it.

That's been the message from a succession of trading days in which even the whisper of resolution to the European sovereign debt problem-a conference call among policy makers, another bailout installment for Greece-sees the market go higher.

Even downbeat economic numbers, like the batch the government released Thursday, weren't enough to derail hopes that Europe won't implode and take the global economy down for the ride.

"Somehow we're back to a risk-on trade again," says David Twibell, president of Custom Portfolio Group in Englewood, Col. "The problem in Europe is, 1) very serious, and 2) there is no easy solution. If there was we would have already solved the problem. The market is being a bit pollyannaish right now."

An announcement that the European Central Bank and its global cohorts are embarking on a program aimed at providing dollars for liquidity-challenged banks served as all the catalyst the market needed to surge.

Those who trade on hope that the plan will fix the debt crisis do so at their own peril, Twibell says.

"If the market is going to be remotely rational, the upside is going to be fairly limited," he says. "We still don't know how the US economy shakes out. The situation in Europe is going to be an overhang. I don' see a lot of upside, and the downside could be substantial if we see a disorderly default in Europe."

Though the problems with European debt and the effect it will have on banks run well beyond liquidity and into actual solvency, the narrative that took hold was that central bankers were taking a proactive step to prevent another catastrophe on the scale of the fall of Lehman Brothers.

The move came on the third anniversary of Lehman's implosion and conjured up memories of the financial crisis that nearly brought down the entire global economy.

"What is the good news? That the big powers in Europe are still adamantly opposed to any kind of debt resolution?" said Walter Zimmerman, senior vice president at United-ICAP in Jersey City, N.J. "Those who don't have a vested interest in European banks look at that and say it's just delusional to think that Greece is going to get out of this without any type of debt restructuring."

The answer to the market's movement, then, could be as much technical as it is based on hopes for European stability.

More