PETALING JAYA: Petroliam Nasional Bhd (Petronas) is expected to award multi-billion ringgit contracts for the development of marginal oil fields by the end of this month to several consortia comprising local and foreign companies.

It is also believed that Petronas will unveil a new business model on the development of the marginal oil fields and possibly, more incentives for the industry.

“The local players will tie up with foreign oil and gas majors in a consortium where the former would have a minor role as it is something new to them. The locals need to learn,” said an industry source.

“Moreover, substantial financial resources are required. (But) This is an opportunity never presented to local companies. They have always been contractors; now they stand to become concession holders.”

The likely victors of the jobs to develop marginal oilfields will come from across the industry as it would involve “different segments of the industry's full value chain”.

“All legitimate players will have a strong role to play,” said the industry source.

.

.

.

.

It is believed that Kencana Petroleum Bhd and SapuraCrest Petroleum Bhd may form an alliance together with a foreign oil and gas major.

SapuraCrest and Kencana have been busy raising capital to fund their expansion plans and are widely speculated to be one of the front runners.

“We are excited ... this would likely involve participation of several local service providers (with strong balance sheet, proven track record and execution abilities and overseas exposure).

“It could also involve strategic tie-ups with independent oil majors and prospecting of strategic assets (floating structures) to develop the marginal fields. If realised, we foresee a re-rating in valuations on the stocks involved in this area,” said Maybank IB Research.

Other potential beneficiaries, according to industry analysts, include Tanjung Offshore Bhd, Petra Energy Bhd, Malaysia Marine and Heavy Engineering Bhd and Perisai Petroleum Teknologi Bhd.

“This will provide more sustainable and predictable cashflow for companies rather than lumpy contracts which most of them are involved in right now,” said an analyst.

The announcement by Petronas is highly anticipated, not least because it marks a major shift in the industry for the first time, Petronas will open up the country's marginal fields to unconventional operators and that too, not just to foreign companies.

“Petronas is looking at different ways of doing business. The concern before has always been deliverability of projects by domestic companies.

“So, local companies have been urged to tie up with foreigners. This would be the second paradigm for the country's oil and gas sector,” said the source.

Enhanced oil recovery and marginal field development are part of the key thrusts under the Government's Economic Transformation Programme.

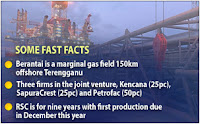

There are about 25 marginal fields that have been identified, of which 10 including Sepat, Cendor Phase 2 and Berantai are ready for development this year. The total production for these marginal fields are expected to reach 1.7 billion barrels of oil equivalent to a total investment of RM70bil to RM75bil.

“From this, we expect RM5bil to RM8bil worth of contracts to be rolled out in 2011,” said TA Research.

“The whole plan to develop harder-to-reach or marginal oil fields also has some major risks that need to be mitigated as it involves the country's assets. Malaysia can't afford to wrongly execute the plan,” said an observer.

Read more...