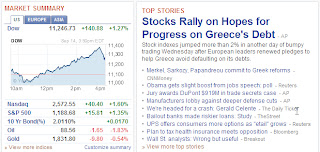

NEW YORK (AP) -- Stock indexes jumped in another day of bumpy trading Wednesday after European leaders renewed pledges to help Greece avoid defaulting on its debts.

The Dow Jones industrial average was up 194 points, or 1.8 percent, to 11,299 at 3 p.m. It had been down as many as 112 points within an hour after the opening bell.

The leaders of Greece, France and Germany agreed in a teleconference that Greece was an "integral" part of the 17-nation bloc that uses the euro. Greece also agreed to abide by agreements to trim its debts. The statements were intended to calm fears that Greece was headed for a default on its debt or might be forced to exit the euro.

European stock indexes rose in the hours leading up to the meeting as investors hoped the talks would be productive. Germany's DAX gained 3.4 percent and France's CAC-40 1.9 percent.

The threat of a Greek default and the damage it could wreak on financial markets has had investors on edge in the past two weeks, lifting Treasurys and weighing on stocks. The yield on the 10-year Treasury note hit a record low on Monday of 1.87 percent and the S&P 500 has only risen three days this month.

Uri Landesman, president of the New York hedge fund Platinum Partners, said worries over Greece have gone too far. Landesmann thinks European countries won't let a Greek default create a larger financial crisis. "They're just not going to let them go under," he said. "That's just not happening. I think people have learned the lesson from letting Lehman Brothers fail."

German Chancellor Angela Merkel distanced herself from comments this week by her vice chancellor and others who suggested a Greek bankruptcy was possible. The finance ministers from the 17 nation-bloc that uses the euro currency will meet on Friday in Poland.

Read more

Grumpy Old Man Syndrome

-

Sometimes we stereotypify something because we can see them in substantive

numbers but we may not understand why they occur. Grumpy old men ... we all

hav...

2 years ago

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.